SamCERA has updated its contribution rates for members and employers.

Category: Retirement Benefits

2015-16 Contribution Rates

Click here to view SamCERA’s 2015-16 contribution rates for members and employers.

2016-17 Contribution Rates

SamCERA has updated its contribution rates for members and employers.

Retirees: 2023 Tax Forms Are Available Now

1099-R tax forms will be mailed by January 31, 2024 to the addresses we have on record for retirees. This form contains information about reportable income and taxable income from SamCERA for 2023. It will also reflect the amount of federal and California taxes that have been withheld, if any.

Access Your 1099-R Online

Your 1099-R is available online to view and print in the MySamCERA member portal.

After logging in, click on “Your Plan” in the navigation menu, then click on 1099R Tax Information, and from there you have the option to view or print a copy of current and past 1099-Rs.

Important Dates and Information About the New 2023 W4-P

The Internal Revenue Service (IRS) revised the W4-P federal tax withholding form in 2022. SamCERA will begin using the new IRS W4-P forms, which are for periodic payments only, on January 1, 2023.

If you need to make new withholding elections or make a change to your current elections, it is important to use the correct form based on your submission date to prevent delays with your withholding elections.

Submitted By 12/15/22: Please continue using the 2021 W4-P form for all tax withholding submissions/changes. SamCERA will reject any 2021 forms received on or after 12/16/22.

Submitted On or After 12/16/22: Please use the new 2022 or 2023 W4-P form for all tax withholding submissions/changes. SamCERA will reject all other forms submitted on or after 12/16/22. Please note, SamCERA will not be able to process any 2023 W4-P withholding elections until 1/1/23.

For more information, see the Tax Information page of the website which includes links to the current form to use and additional information about tax withholdings.

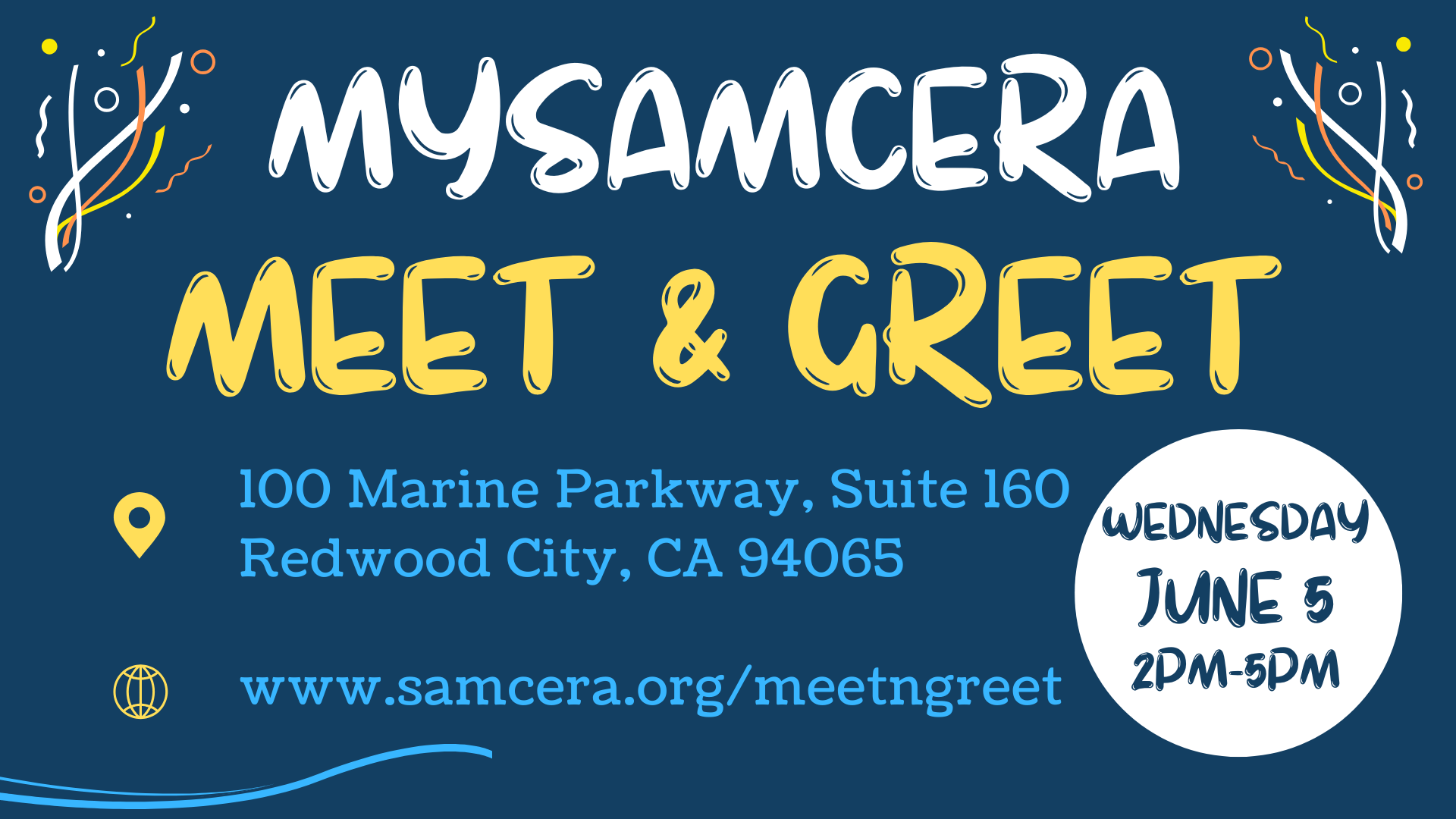

Retirees, join us at SamCERA on June 5th to learn all about your MySamCERA account

Location: SamCERA Boardroom 100 Marine Parkway, Suite 160 Redwood City, CA 94065

Date: Wednesday, June 5, 2024

Time: 2:00 p.m. – 5:00 p.m.

Join us at SamCERA on Wednesday, June 5th to learn all about your MySamCERA account and how to manage your pension.

Learn how to:

- Register for a new account

- View & print your 1099-R

- Generate a pension income verification letter

- Explore features on your MySamCERA account

Questions?

If you have any questions, please email samcera@samcera.org.

2023 Service Purchase Schedule

Depending on your circumstances, you may be eligible to purchase service credit that can count toward your total years of service and may increase your retirement benefit.

Purchase Request forms may be submitted for the purchase of Extra Help time, Plan 3 and Plan 5 service upgrades, certain military leave, unpaid sick leave, and parental leave. Returning SamCERA members can also make a Purchase Request for a redeposit of withdrawn funds.

SamCERA members have two separate periods of time during 2023 to make service purchases. The process starts when the member submits a Purchase Request form.

First Period

- SamCERA begins processing Purchase Request forms: February 1, 2023

- Deadline to submit Purchase Request Form: April 28, 2023

- Deadline for all money to be received by SamCERA with agreement: June 1, 2023

Second Period

- SamCERA begins processing Purchase Request forms: August 1, 2023

- Deadline to submit Purchase Request Form: October 31, 2023

- Deadline for all money to be received by SamCERA with agreement: December 7, 2023

You can find a copy of the SamCERA Purchase Request form on the SamCERA forms page.

Contact SamCERA for more information about service purchases.

Empower (formerly known as Mass Mutual) Plan-to-Plan Transfer

The 2023 deadlines to submit the Empower Plan-to-Plan Transfer to Purchase Service Credit form to San Mateo County Human Resources are:

- May 18, 2023 by 12:00 PM (PST)

- November 16, 2023 by 12:00 PM (PST)

For more information about an Empower Plan-to-Plan transfer, please contact benefits@smcgov.org.

Compensation Limits for 2023

“Compensation limits” do not refer to restrictions on the amount of salary your employer can pay you. Rather, this term refers the maximum amount of compensation SamCERA can take into account when determining your contributions and calculating your monthly pension benefit under your retirement plan. The two primary “compensation limits” that impact SamCERA members are: 1) Limits set forth In the Public Employees’ Pension Reform Act (PEPRA) which establish the maximum amount of compensation that can be used to calculate the pension benefits for Plan 7 members; and 2) Limits set forth in the United States Internal Revenue Code regarding the maximum amount of compensation that can be used to calculate the pension benefits of any SamCERA member, regardless of their plan.

Both of these compensation limits are adjusted each year pursuant to the provisions of the above-referenced statutes. See below for the relevant 2023 compensation limits based on your plan and membership with SamCERA.

2023 Pensionable Compensation Limits for Plan 7 Members

Under PEPRA, SamCERA’s “Plan 7″ members are subject to pensionable compensation limits that are set by statute.

In 2023, the annual pensionable compensation limits for PEPRA members are:

- General Plan 7 Members (County & Court): $146,042

- General Plan 7 Members (Mosquito & Vector Control District): $175,250

- Safety & Probation Plan 7 Members (County): $175,250

2023 IRS Compensation Limit

Regardless of your plan, the IRS sets a limit each year on the amount of compensation which can be used to calculate your monthly pension benefit. This limit applies to all SamCERA members hired after July 1, 1996. In 2023, the IRS annual compensation limit (for pension calculation purposes) is $330,000.

Questions? Please email samcera@samcera.org.

Retirees: 2022 Tax Forms Are Available Now

1099-R tax forms were mailed on January 11, 2023 to the addresses we have on record for retirees. This form contains information about reportable income and taxable income from SamCERA for 2022. It will also reflect the amount of federal and California taxes that have been withheld, if any.

Access Your 1099-R Online

Your 1099-R is available online to view and print in the MySamCERA member portal.

After logging in, click on “My 1099R’s” in the navigation menu, and from there you have the option to view or print a copy of current and past 1099-Rs.

Compensation Limits for 2025

“Compensation limits” do not refer to restrictions on the amount of salary your employer can pay you. Rather, this term refers the maximum amount of compensation SamCERA can take into account when determining your contributions and calculating your monthly pension benefit under your retirement plan. The two primary “compensation limits” that impact SamCERA members are: 1) Limits set forth In the Public Employees’ Pension Reform Act (PEPRA) which establish the maximum amount of compensation that can be used to calculate the pension benefits for Plan 7 members; and 2) Limits set forth in the United States Internal Revenue Code regarding the maximum amount of compensation that can be used to calculate the pension benefits of any SamCERA member, regardless of their plan.

Both of these compensation limits are adjusted each year pursuant to the provisions of the above-referenced statutes. See below for the relevant 2025 compensation limits based on your plan and membership with SamCERA.

2025 Pensionable Compensation Limits for Plan 7 Members

Under PEPRA, SamCERA’s “Plan 7″ members are subject to pensionable compensation limits that are set by statute.

In 2025, the annual pensionable compensation limits for PEPRA members are:

- General Plan 7 Members (County & Court): $155,081

- General Plan 7 Members (Mosquito & Vector Control District): $186,096

- Safety & Probation Plan 7 Members (County): $186,096

2025 IRS Compensation Limit

Regardless of your plan, the IRS sets a limit each year on the amount of compensation which can be used to calculate your monthly pension benefit. This limit applies to all SamCERA members hired after July 1, 1996. In 2025, the IRS annual compensation limit (for pension calculation purposes) is $350,000.

Questions? Please email samcera@samcera.org.